Usual question asked during Financial Discussion with clients is, when are you planning to retire? reply will be immediate, Ravi lot of time for that, lets concentrate on some other goals. But, please keep in mind that Retirement is the most important goal and should be done as a priority. For any other goals like children education or marriage you can always take loan (not recommended though) if you are short of funds and repay it, but once you are retired and if you out live your savings who will fund your expenses.

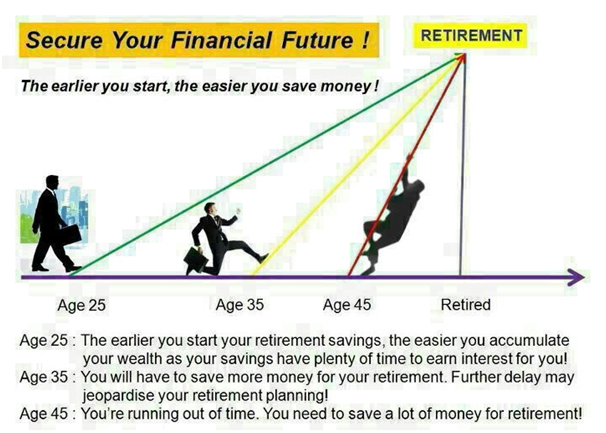

Its better to plan for Retirement as the first goal and keep building enough corpus for the same. If we have surplus we can always pass on the available corpus for our loved ones. Came across this picture in my whatsapp and thought will share for it with you all.

As you can see for yourself, the journey is very steep once you cross 40 comparing 25 or 30. All this is due to the compounding factor. when you start early your investment will spend more time in the Markets (be it Debt or Equity) and will earn more returns for you and thereby makes you to achieve your goal easily. That’s the power of compounding.

Happy Compounding!

R♥Vi

Be First to Comment