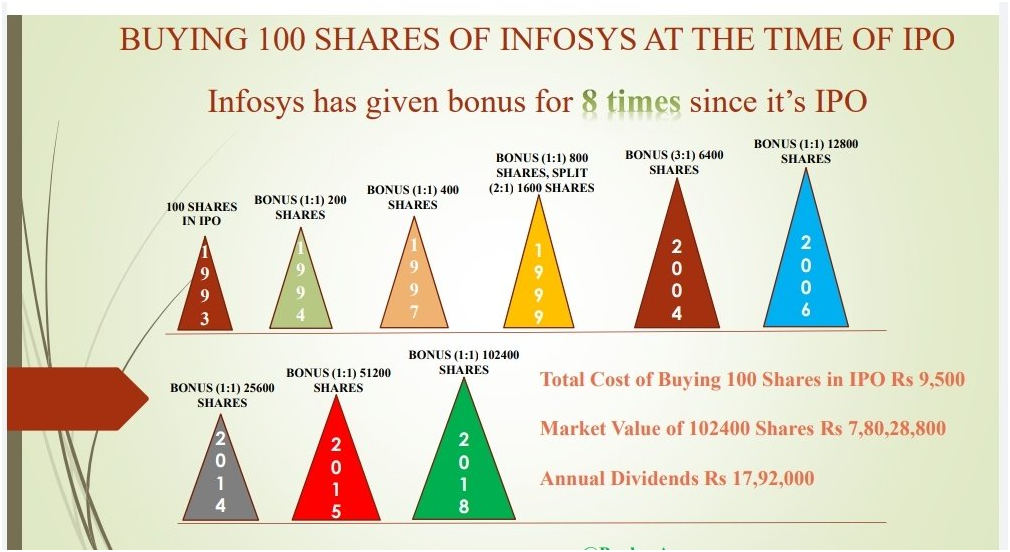

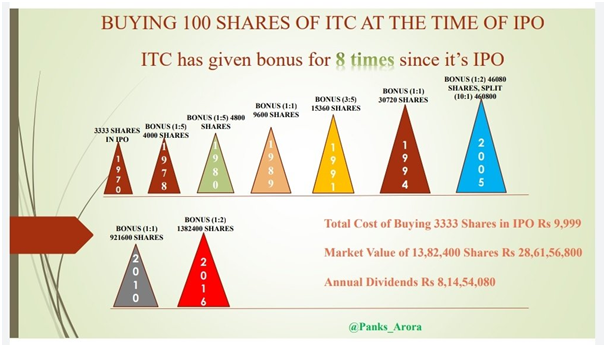

Recently i came across details about how if someone had invested in the IPO of two current large cap stocks would have benefited at the current market price. IPO of one stock came in 1970 and the other in 1993 and there were lot of Bonus Issue, Stock Split plus Dividends. As these increased the share holdings, the dividends took care of the liquidity and if someone who had invested in IPO and still holding they would have made a huge capital gain apart from the Dividends. The below is the working of the same –

Look at the wealth created over the long term, if you feel that investing Rs.10000 in 70’s of 90’s is too high, its equivalent to few lakhs at this current time etc. sorry you have understood the essence of the message. The point here is whatever is the amount of investment, if you can stay invested for longer period of time you are sure to multiply your money multiple times. The only thing is you must ignore the noise around and you might experience multiple years of under performance, the stock price might not move for years together etc.

I would request you to go through the below post to understand the above points in detail.

Happy Investing!

R♥Vi

The calculation is taken from Twitter. I am not sure about the authenticity of the calculations. This is not a recommendation, please consult your advisor before investing.

Be First to Comment