COVID-19 “virus has changed all aspects of life. It has not only developed medical emergency worldwide but also affected the Economies and Markets. The market correction has been savage and nothing has been spared. The best of blue chips have been battered. So have mid and small caps. Not only the quantum of fall but the pace in which i fell made everyone worried.

What could have helped?

One good thing this crash has brought into investors and Advisors mindset is Importance of Asset Allocation. What is Asset Allocation? Different asset classes (equity, debt, gold etc) behave differently under various market and economic conditions. During these times a prudent asset allocation strategy will help you. As these assets behave differently they have very low correlation and adding assets with low correlation helps you to reduce the overall portfolio volatility and thereby increase the portfolio returns.

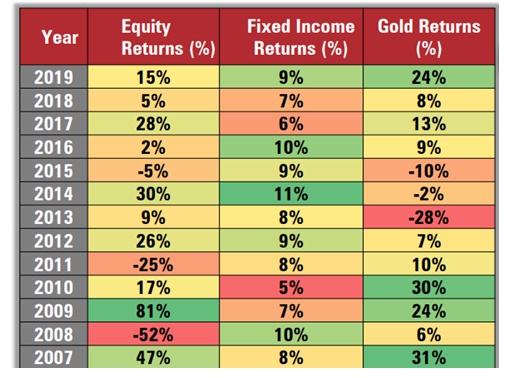

Below is the return history of various financial assets:

As you can see, no asset class go up or come down together and the sad part is they don’t take turns in performing so literally no one will have idea of which one is going to go up next year. So investing among these asset classes will help you make better returns.

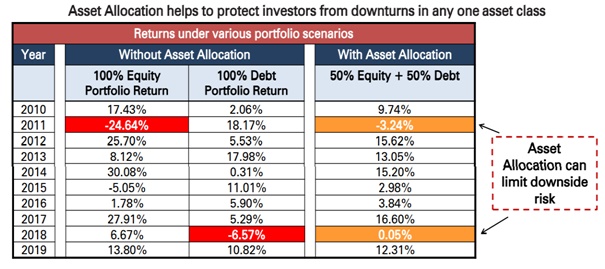

How does it help?

Now imagine you have two different portfolios, one with 81% exposure to equities and another one with just 45% and the market crashes by 36% which one of your portfolio will be least affected? Obviously the second portfolio with just 45% equities and iam sure you must have invested the rest of your money in either Debt Funds or Gold or even Fixed Deposits.

Though your equity portion would have suffered drawdown but your investments in other asset class would have taken care of the loss in equities. It would atleast arrest the downfall in your portfolio, and if you are able to arrest the downfall then the portfolio doesn’t have to struggle to give you extra returns.

What is the best asset allocation strategy? I don’t know, it depends on your age, family members and how many are earning, any alternate source of income, how much risk you can take etc. So my strategy of 80:20 may not suit you.

You might also alter the strategy based on the market conditions; your current allocation to equity may be 45% but due to this fall you might want to increase slightly to 51% or your son or daughter has started earning, so you would like to increase your equity exposure.

All iam saying is , don’t waste your time on calculating how much in each asset class every month or quarter, but make sure that you have one before starting and you monitor it every year.

And before deciding the percentage allocations keep this in mind PORTFOLIO SHOULD BE RISK-BASED, NOT RETURN-BASED.

Happy Investing!

R♥Vi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Be First to Comment