Last post, i discussed about few shot term investment available, the most attractive among the lot is Debt Mutual funds. I aware that Debt MF were in the news recently for all the wrong reasons, but, i can say with confidence that Debt MFs are the best for investing for short term, I am not saying this as a Mutual Fund Distributor, iam saying this as an Investor too.

Debt funds can provide Stable Returns plus Liquidity, though it ranks few points lower than traditional options like Fixed Deposit or RD under Safety parameter. But Debt funds if invested in the right scheme can provide you better returns than FD.

WHY DEBT MUTUAL FUNDS?

Debt Mutual Funds provide the closest alternative to a savings bank account and fixed deposit. As you know, savings account is preferred for its liquidity with lower risk & Fixed Deposits for their better returns. Short-term debt funds provides the best of both worlds – LIQUIDITY & BETTER RETURNS with LOWER RISK. These funds invest in fixed income securities like government securities, government T bills, corporate bonds, and deposits. We also have instant credit upto certain amount, which will surely take care of the liquidity factor which is available in Savings Account.

Investments in Dynamic funds or Medium Term fund will be a very good alternative for Fixed Deposit, as you can use indexation benefit.

Though, there are a large number of categories within the fixed income space, we recommend you to stick to high quality debt funds as they provide a combination of liquidity, low risk and better returns.

| SAVINGS ACCOUNT (liquidity) |

+ | FIXED DEPOSIT (Better returns) |

= | DEBT FUNDS (liquidity & better returns) |

Historically, majority of the times these funds have outperformed the returns of the savings account and fixed deposits on a post-tax basis

WHICH FUND TO INVEST?

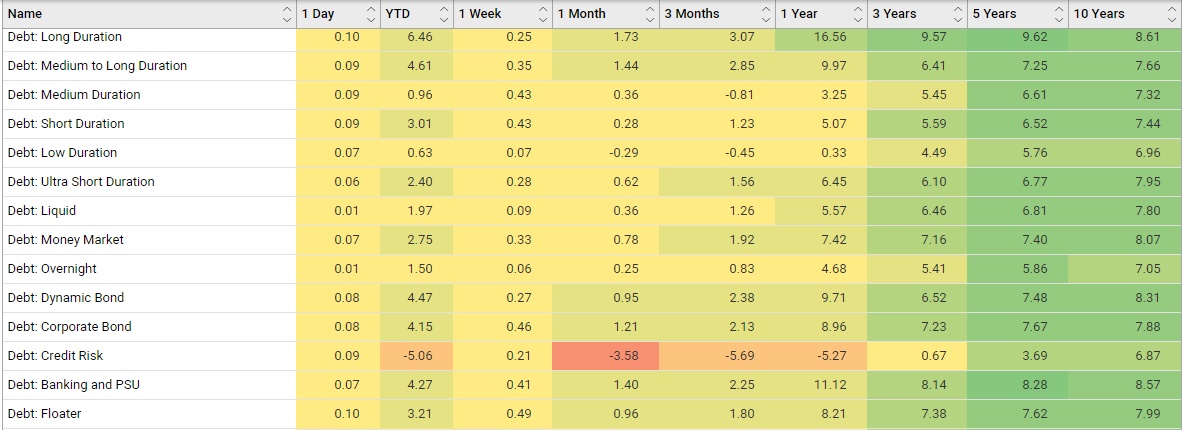

As quoted earlier, there are lot of sub-categories among Debt funds and which category to choose will purely depend on your time horizon. I will provide you the recent performance snapshot of all Debt Funds, these are average returns and obviously certain funds have performed far better.

These are average category returns taken from Value Research, please check with your Advisor / Distributor before investing.

These are average category returns taken from Value Research, please check with your Advisor / Distributor before investing.

If you are looking to park your short term money or looking for better alternative than Fixed Deposits, you can surely explore Debt Funds.

Happy Investing!

RaVi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Be First to Comment